In Canada, where I live, electricity is cheap and abundant. In fact there are routinely surpluses that governments are happy to sell for cheap to power-hungry “industries” like Bitcoin mining. Governments at all levels, once convinced that these mines are a valid industry and that the taxes, jobs and abandoned industrial buildings renovated are a great windfall, will practically bend over to welcome them in their area.

Of course the only real winners in this system are the big farms who enjoy lower electricity rates and help programs. In the long run, everybody else loses; even the electricity producers that were happy to sell their surpluses could have sold that electricity to home miners at a higher price if they had not killed the goose that lays the golden egg by helping big farms grow into something home miners can’t compete with.

I can’t blame the big farms for acting greedily; that’s their only reason for being. I think the real problem is government officials not being educated properly, being convinced that a surplus of hash power is actually a valid industry, and not understanding the process in general. I thought I would help out by comparing Big Farm mining to something that is eerily similar but easier to understand; ticket scalpers.

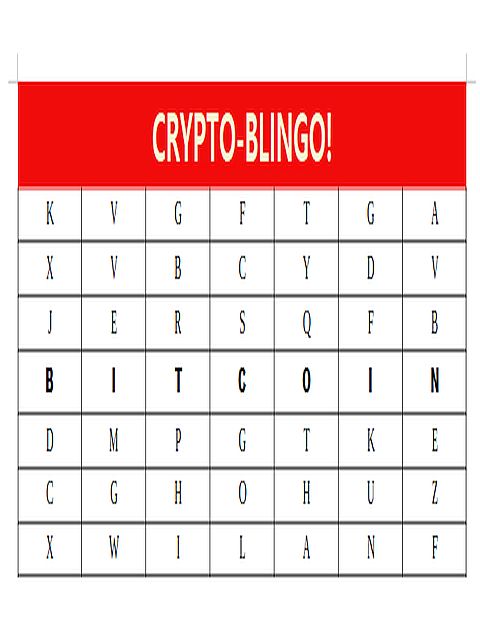

Imagine the world’s biggest Bingo! game:

- There are as many ticket booths as people need where people can buy a game card.

- They pay for a card and the attendant walks to the printer, prints a card with random letters on it, walks back and hand it to the buyer.

- People buy as many cards from as many booths as they want until someone buys a winning card and shows it to the booth attendant.

- Then the game starts over. [The number of cards you can buy in a second is what’s called Hash Power in crypto-speak]

- The lucky card has bingo! randomly written on it, but it can be another, longer word the more there are ticket booths.

- A longer word means it becomes more difficult to generate the lucky card. This way the average win time stays around 10 minutes.

Normal players use one or two booths, buying a few tickets to win the prize, maybe a ticket to a Céline Dion concert or a lifetime supply of couture diapers. But Big Miners have splurged on roller skates for themselves and the booth employees so the buying process goes much faster and they can start buying before everybody else. [Ultrafast Internet is a very rewarding expense for Big Miners, being able to act first can compensate for weak hash power] They also buy many more tickets from many more booths than individuals. Generally, as soon as they win the prize they sell it to cover their expenses, to buy more tickets and to access more booths.

Because they can buy first and buy a lot more tickets than normal users, Big Miners behave exactly like ticket scalpers. They increase costs and block access to tickets for normal users and sell the prizes at a higher value than its actual worth. They generate no products, add no value and are basically just extra tickets to the game. This is exactly the same for real mining where Big Miners are simply generating a surplus of unnecessary hash power and denying the average user the chance to mine at home. Electricity can be sold to home miners at a better price than “industrial” rates, and millions of people could make a tiny profit instead of only 2-3 big mine owners.

Big Mining isn’t an industry, it’s a scam that only benefits the few lobbyists that have had the brilliant idea of sticking the “industry” label on it for politicians to salivate over.